An Easy Way to Invest Your Money – Part 2

This past week was very nice for those of us who were broadly invested in both the Toronto and Dow Jones stock markets. We were patiently anticipating a recovery and were at least partially rewarded for not selling and triggering a loss. For those of you who are playing the long game by purchasing regularly, regardless of how the stock market is doing, you might have larger smiles on your faces because the purchases made through the spring and summer months should be showing gains due to Dollar Cost Averaging.

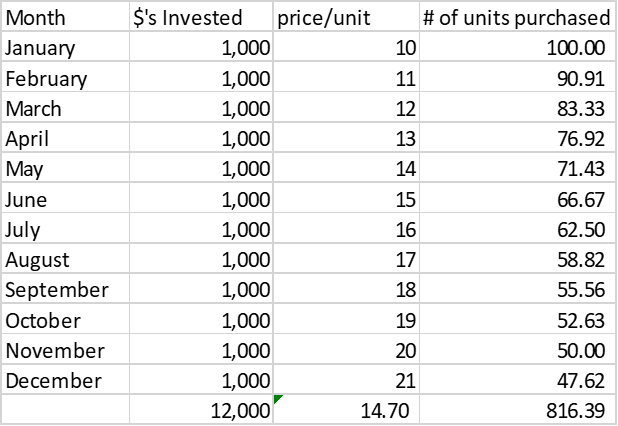

This week’s story will show you what can happen when you invest a consistent amount of money into an investment that is going up in value each month. The attached spreadsheet shows that in each successive month as the price is going up, you will be purchasing fewer and fewer units with each dollar invested. The average price per unit in this illustration is $14.70/unit. The value of the account after the last purchase in December is ($14.70 x 816.39) =$12,000.93 – which is simply a breakeven proposition.

The lesson from this week’s illustration, after you compare it to last week’s blog, shows that a continual upmarket is not necessarily your best friend if you are purchasing in small amounts every period, especially if you are a short-term investor.

**For those of us with a significant amount of money just sitting in our savings/checking accounts, had we invested $12,000 in January of this hypothetical calendar year, we would have doubled our money in this illustration. Showing the math, ((On January 1st we purchased 1200 units at $10/unit. In December the price is now $21/unit.) (1200 units x $21 = $25,200)). ?**

Al’s Nuggets:

- The stock market is simply a gathering place where people buy and sell goods, commodities, or livestock. If you have mutual funds or participate through your employer’s group retirement plan, you are in the stock market!

- It’s been my experience that trust, time, research and discipline are vital to making money.

- The only thing easy about money is losing it. If you want to get ahead, see #2 above!

- You cannot time the market! We never know when the value of an investment will drop or rise in price. For this reason, it’s ideal to embrace a variety of strategies!

- Guaranteed savings are not risk free! That is next week’s story!